The Ultimate Guide To Mileagewise

Table of ContentsGetting The Mileagewise To WorkThe Ultimate Guide To MileagewiseAn Unbiased View of MileagewiseMileagewise Things To Know Before You BuyMileagewise for Dummies

Contrast it with the sustaining documents to locate any kind of distinctions. By following these suggestions, you can preserve precise gas mileage records and be planned for the IRS or any type of various other relevant examination. An organized mileage log has even more benefits. For instance, a detailed document of your company trips can aid you analyze your driving.This can lead to cost financial savings in regards to gas usage and automobile upkeep. Likewise, a precise mileage log can help track and record overhead. By connecting each journey to its objective, you can easily discover the proportion of mileage relevant to your service. This details is important for getting reimbursements or asserting deductions.

By the end of this overview, you'll be equipped with the info you require to develop an affordable and reliable system for recording your mileage throughout the year. Ready? Allow's obtain monitoring. Business mileage is any kind of range you drive for organization functions, like traveling for customer meetings, provider gos to and deliveries.

A gas mileage log is necessary for any individual who wants to deduct lorry expenses on their taxes. There are 2 primary techniques for asserting lorry costs:: You deduct a level price per company mile driven as established by the IRS.

All About Mileagewise

: You subtract the upkeep, insurance policy, depreciation, and gas prices for your vehicle. This is the most exact way to assert your reduction and is sometimes extra beneficial than the common deduction if you have a costlier lorry. Criterion gas mileage is commonly far better for those that don't wish to spend a whole lot of time monitoring every little automobile expenditure.

It's a wonderful fit for those who desire to conserve both time and cash and whose driving-related expenses are relatively low. The actual expenditure approach can be better for those that spend a great deal on their automobiles. Perhaps you drive a luxury vehicle with expensive parts, your automobile is older and calls for constant repair work, has high insurance policy premiums, or doesn't get great gas mileage.

However, it deserves mentioning that this approach calls for extra diligent record-keeping. You'll require to save all the receipts and track every cost. This can be time-consuming yet can settle if your costs are high. To follow the internal revenue service's policies, you'll need to track four pieces of details concerning every business journey: The first point to track is the day of the drive and the time the trip took place.

A lot of individuals record the start and finishing odometer analyses. You are called for to differentiate between miles utilized for business and individual reasonsso if you're not driving your vehicle for service purposes all the time, it's finest to videotape the gas mileage for every trip to be extremely secure.

Not known Details About Mileagewise

Here is where you can (and should!) get involved in the information. You do not need to create an unique, however the even more information, the much better. At the very least, make sure to describe the individual you visited and the factor for the journey. It's additionally an excellent concept (though not called for) to keep supporting documents of your trips whenever possible (Mileage tracker app).

This will certainly consist of maintaining track of the miles driven for each.: Despite the fact that you're not calculating a reduction based upon mileage, a gas mileage log can still be incredibly practical. You can keep a note pad in your cars and truck or utilize a mobile app created for this objective. Record the date, miles driven, location, and purpose for each business-related trip.

Maintaining updated documents assists you precisely assert your miles at the end of the year and avoid of problem in the occasion of an audit. You'll likewise intend to evaluate and resolve your log oftenonce a week or as soon as a month, depending on the frequency of company journeys. This is to make certain the precision of your documents and to decrease tension at tax obligation time.

The Mileagewise PDFs

There's no one-size-fits-all option for tracking service miles; the ideal approach will certainly depend on a selection of aspects, consisting of the dimension of your service, your budget, and your individual preferences. Not sure what device is appropriate for your organization?

Lots of apps permit you to classify trips as company or individual, record trip details, and create records for expenditure repayment or tax obligation functions. Applications offer a wide variety of customers, from small business proprietors to independent professionals. Pros: Conserve time and decrease hands-on entrance mistakes. Obtain accurate and automatic gas mileage documents.

You reduce the possibilities of human mistake. It's terrific for companies with bigger lorry fleets. Disadvantages: You'll invest a whole lot upfront to cover the cost of the tools. You need to ensure the gadgets are compatible with your car's make and design or spend in compatible vehicles. You'll spend substantial time reviewing your options.

Mileagewise for Beginners

(https://lnk.bio/mileagewise1)As the name suggests, with this method, you by hand document journey detailseither in a physical logbook or spread sheet (like Excel or Google Sheets). Pros: No charge. You can easily tailor your record logs to fit your requirements. It's great for businesses with low mileage monitoring. Disadvantages: Your documents are much more prone to human error.

Now, maintain in mindthose attributes are commonly behind paywalls (Mileage tracker app). Yet usually, rates for gas mileage monitoring apps is reasonable and inexpensive, ranging in between $60 and $200 a year for an individual or small company. And when you integrate your mileage tracking with the remainder of your bookkeeping software program, you can conserve on your own added time

Rider Strong Then & Now!

Rider Strong Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Traci Lords Then & Now!

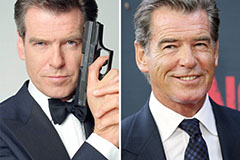

Traci Lords Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!